Federal Tax Credits:Wood Burning Stoves & Inserts

Wood burning or pellet burning stoves and inserts are a great way to heat your home. And Uncle Sam agrees so much that the IRS will give you a tax credit!

Requirements for Tax Credits:

Thermal efficiency rating (HHV) of at least 75%

Must be installed and in use during the year you apply. Credit for 2022 was 26% with a cap of $2000. In 2023 it increased to 30% with a cap of $2000.

Use IRS Form 5695 to claim your credit: https://www.irs.gov/forms-pubs/about-form-5695

More information on wood burning efficiency and safety can be found here:

Wood Burning Efficiency & Safety

JANUARY 11, 2021 UPDATE: Beginning in 2021, consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems were able to claim a 26% tax credit. This provision is part of the BTU Act, which has been actively supported by HPBA for the last several years and has been part of our Advocacy Day requests to Members of Congress.

For 2023 this credit is increased to 30% with a $2000 cap.

Requirements: Qualifying products (any biomass-fueled heater) must have a thermal efficiency of at least 75 percent efficient per the higher heating value (HHV) of the fuel.

The EPA certified wood heater database may be referenced.

At Chimney Clean Company we sell and install qualifying wood inserts and pellet stoves and can help you qualify for this tax credit while lowering your energy bill with alternative heat sources.

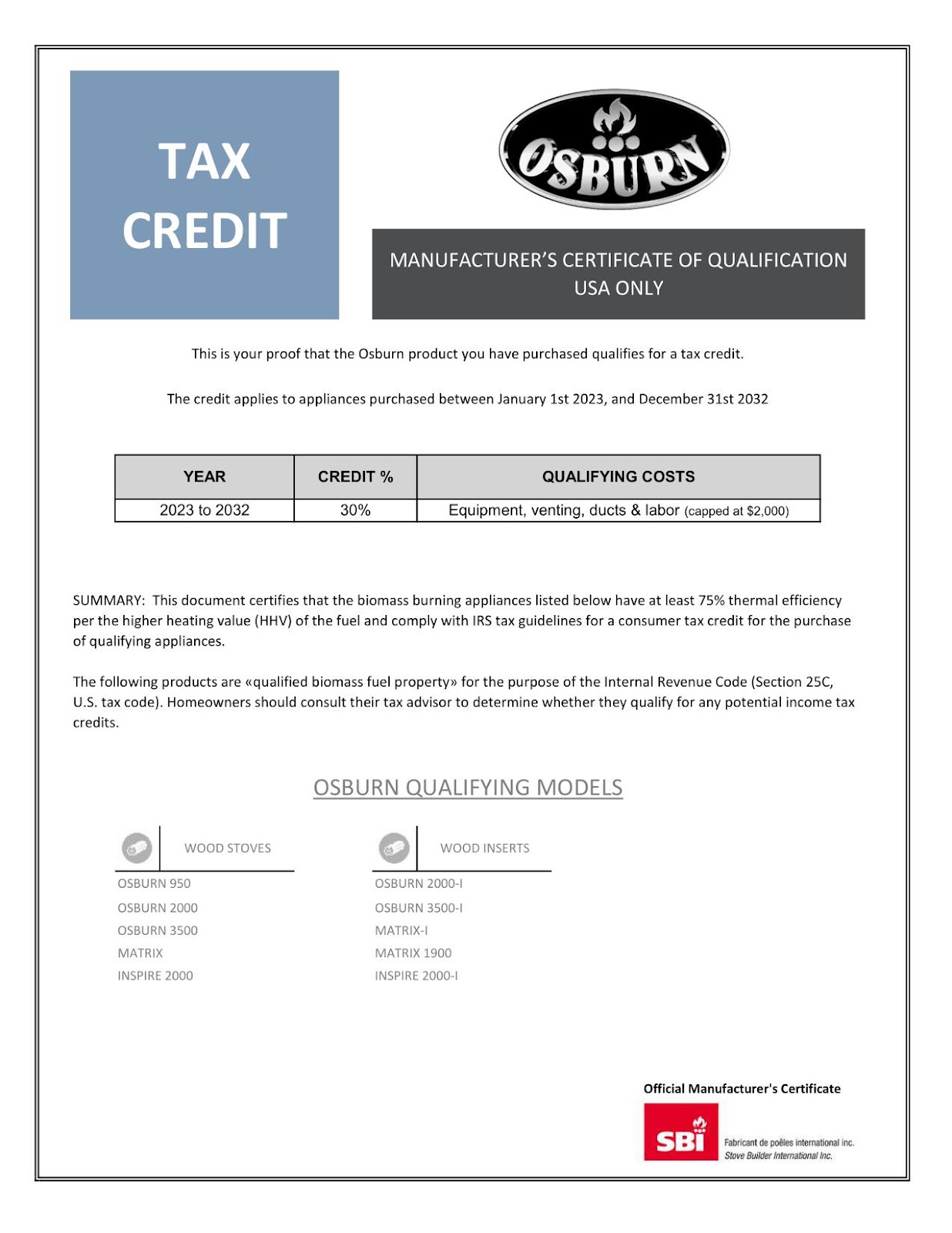

We prefer Osburn stoves and inserts for quality, performance, ease of installation and maintenance. See below for the specifications of their stoves.

Qualifying Stoves sold by Chimney Clean Company:

If you are interested in a wood burning stove or insert Chimney Clean Company is ready to help.